I have been digging around New Zealand the past week or so. I have not found any stocks I would act on right away, but I did find a few interesting business models that could make for good trades later. Summerset is one and I’ll focus on that here. Fonterra is another. I also went ahead and shorted the New Zealand Dollar (short NZD/USD), but that is for another post.

Summerset Group (SNZ.ASX)

This is a short candidate but not now. Summerset is a developer and operator of retirement villages and aged care facilities in New Zealand. Looking past the healthcare angle however, Summerset essentially borrows money from old people to speculate in properties. This I will explain in the paragraphs to follow. I will also explain why this could be a good short and when to short it.

The Business Model

Summerset’s business model produces 3 cash flows. First, you (the retirees/customers) pay around $300-500k NZD upfront, for the right to live in the villa/townhouse/apartment units. Second, you pay a weekly contribution toward village operations (for things like water, staff, activities…etc). Third, when you decide to leave (or die), you or your estate get 75-80% of your initial money back (Summerset keeps 20-25% of initial amount as “Deferred Management Fee”). It’s important that the customer don’t actually get ownership, and Summerset gets the capital gain from any price appreciation when units are resold.

Follow the cash flows above, Summerset basically borrows money from retirees, pay a negative interest rate (the weekly contributions), and pay back 75-80% of principal at the end. What do they do with that borrowing? They build/develop more properties.

The accounting reflects these economics. The large amounts that customers pay upfront are in fact booked as “Residents’ Loans”, a liability on Summerset’s balance sheet. The footnotes then attribute the asset “Investment Property” as the sum of residents’ loans and Summerset’s equity. On the income statement, main revenue sources are the weekly fees, the amortized deferred management fees, as well as any valuation gains in investment properties.

Main Sources of Profit

Of the various revenue sources, property value gains are the main source of profit. Without that Summerset would barely breakeven or be cash flow negative. A quick look at the financial statements will make this clear.

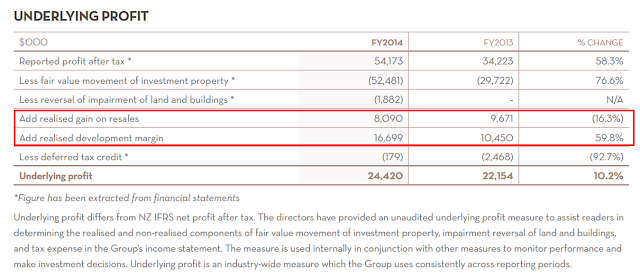

First, in the income statement if you back out the “Fair value movement of investment property”, pretax income would be close to $0. Second (as shown below), management’s non-GAAP “underlying profits” shows that profit came solely from “realized gain on resales” and “realized development margin”. This should make clear that Summerset is essentially a profit developer and heavily dependent on property value.

I also wonder what fair value really means. In Summerset’s business model, a sale of “License to Occupy” is not a true sale of property, but rather a retiree lending money to the company. Are those transaction prices really reflective of property value? The annual report does have this to say – but that doesn’t tell me much: “The fair value of the Group’s investment property is determined on a semi-annual basis, based on market values, being the estimated amount for which a property could be exchanged on the date of the valuation between a willing buyer and a willing seller in an arm’s length transaction after proper marketing wherein the parties had each acted knowledgeably, prudently and without compulsion”.

Let’s move on to the cash flows statement, which shows similar results. Without the borrowing from resident’s loans, cash flow from operations would actually be negative.

Leverage and Liquidity

I have nothing against property development or land speculation. When times are good this is a fine business model. Even the liquidity risk from resident departure /loan redemption is mitigated, as Summerset contractually do not have to repay the “resident’s loan” until they receive money from a new buyer.

But it’s also obvious that Summerset would be in trouble when there’s a big property down turn. The company is leveraged 3x in terms of asset to equities. There is very little cash on hand, and the bulk of its assets are in illiquid assets such as land, buildings, equipment…etc. An economic downturn could lead to higher retiree departure and loan redemptions (to free up cash for other uses like supporting their unemployed children). Competitors could have their own liquidity issue leading to a downward spiral of asset value impairments. If resale values are lower than residents’ loans, and new sales are low (most likely in a property downturn) then the company could have trouble redeeming residents loans. At the minimum we’ll see some ugly margins if not liquidity issues and lawsuits.

What to Do?

So yes, Summerset is basically a highly leveraged builder that borrows money from grandmothers. Its profits are completely dependent on property value gains. Meanwhile news media is full of reports about NZ being in a property bubble, with one of the most expensive housing markets in the world. The stock is trading at more than 2x P/B.

All these make SNZ a short, but not yet: 1) I actually think the property market has more room to run, as much of the price gains are due to supply constraints in Auckland. 2) This is further supported by NZ’s central bank easy monetary policy. 3) Summerset’s sales were strong in 1Q15 and its stock is showing bullish technicals.

If not now, then when? I am waiting for signs of credit deceleration from the banks before acting on this. Before retirees pay Summerset hundreds of thousands for a “License to Occupy”, they have to sell their existing homes to someone else, so Summerset needs a solid housing and credit environment.

What I can see happening is the NZ property market continue to run for a while as the central bank keep lowering rates to depreciate the NZ Dollar and keep its exports competitive (think Fonterra and its farmers). The low rates encourage building and could lead to oversupply of retirement homes. Eventually monetary policy will stabilize and loan growth at the banks will slow. Slower credit and oversupply of buildings would then have a depressive impact on property values, crushing Summerset’s margins and stock price.

Interestingly, bank stocks (it’s the same big 4 that dominate both Australia and NZ) have shown weaknesses in the last month while Summerset and its peers have stayed strong. The two cannot diverge forever.