NexPoint Residential Trust (NXRT) is a dividend growth play. They own and operate apartment buildings in the south. I view NXRT as having both defensiveness and optionality.

Defensiveness comes from the fact that NexPoint invest in Class B apartments, which are actually more defensive than high end Class A’s because tenants live there not out luxury, but of necessity. Growth optionality comes from their strategy of buying apartments that they can rehabilitate, which then allow them to raise the rent.

The company's geographic exposure is below. In this article I want think through a stress case on NXRT, then some of the more qualitative factors.

Defining the Stress Case

- Atlanta: 14.6% - 18.4%

- Charlotte: 10.9% -14.6%

- Dallas: 9.9%-14.2%

- Nashville: 5.7%-10.9%

- Orlando: 18.2%-28.1%

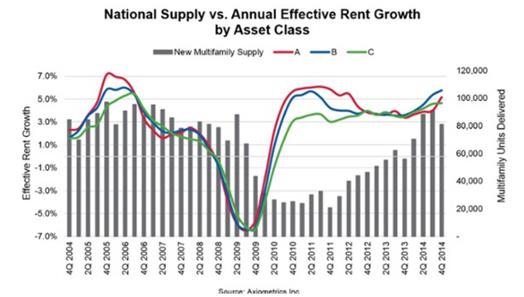

How about rental prices? According to Axiometrics, class B rent growth went negative for about 7 quarters from 4Q2008 to 1Q2010. Importantly, rent never declined more than 10% before it rebounded.

So I think a reasonable stress case for NXRT would be 85% occupancy and 10% rent cut from current levels. Since we’re modeling stressful times, I assume they cut down a little on G&A expenses and shut off all capital expenditures, which is not good but understandable.

In this stress scenario NXRT can still get to ~$16mm of funds from operations (FFO) which, along with cash on hand, should let them maintain current dividend of $17.5mm per year. Realistically, if they get to that point I would expect a dividend cut, but the point is even in stress scenarios NXRT will generate enough cash to have options.

The credit and liquidity picture looks fine. They are highly leveraged but no big maturities until 2020+.

Quality of Apartments - Need to Get Better

In the table below I listed out NXRT’s properties. The four columns on the right (highlighted in green) shows 1) number of reviews, 2) percentage of reviewers that recommend that particular apartment, 3) average percentage of “recommends” for apartments in that city, 4) difference between NXRT’s property versus city average.

This is not pretty. Nexpoint’s properties in Texas generally get much worse reviews than city averages. Some of their Florida properties get excellent reviews. In general though, this is a picture of lower quality versus peers.

I understand NXRT’s strategy is buy apartments and rehab them, so arguably it’s the migration of ratings that matters, not ratings at a snapshot in time. Unfortunately, NXRT do not have any rating improvement data. The only related data are improving occupancies and higher rents – which are functions of not just quality, but also overall industry demand.

On the positive side, clearly they have lots of room and options for improvement.

For valuation I have always struggled to determining an appropriate amount of “maintenance capital expenditure” to deduct from FFO. This gets a bit hazy as some of the natural decays of the building might be offset by regular maintenance and repair expenses, which are already charged through the income statement. (The IR person I spoke to argues that it’s all accounted for in the income statement, so there’s no need for a separate maintenance capex deduction. But I think that’s a bit aggressive since repairs are expensed, but you still get one-off replacements like roofing/tiles which are not).

I ended up using an extremely rough proxy. Maintenance capex from fellow apartment REITS UDR and Post Properties are stated at $1150-1250 per unit. For NXRT that works out to ~16mm of maintenance capex. The company currently has about $34mm of FFO (which mirrors cash flow from operations excluding working capital); deducting $16mm maintenance capex would leave $18mm of free cash flow, which is almost 100% used toward paying dividends.

Since free cash flow mirrors dividend payments, this also means FCF yield = dividend yield = ~6.2% at the current price of $13.2 per share.

I would give this idea a B. It has enough defensiveness and growth optionality, but the apartment reviews are something to monitor. That NXRT is externally managed is another ding. I have a small amount of NXRT in my IRA account.

I understand NXRT’s strategy is buy apartments and rehab them, so arguably it’s the migration of ratings that matters, not ratings at a snapshot in time. Unfortunately, NXRT do not have any rating improvement data. The only related data are improving occupancies and higher rents – which are functions of not just quality, but also overall industry demand.

On the positive side, clearly they have lots of room and options for improvement.

Valuation

For valuation I have always struggled to determining an appropriate amount of “maintenance capital expenditure” to deduct from FFO. This gets a bit hazy as some of the natural decays of the building might be offset by regular maintenance and repair expenses, which are already charged through the income statement. (The IR person I spoke to argues that it’s all accounted for in the income statement, so there’s no need for a separate maintenance capex deduction. But I think that’s a bit aggressive since repairs are expensed, but you still get one-off replacements like roofing/tiles which are not).

I ended up using an extremely rough proxy. Maintenance capex from fellow apartment REITS UDR and Post Properties are stated at $1150-1250 per unit. For NXRT that works out to ~16mm of maintenance capex. The company currently has about $34mm of FFO (which mirrors cash flow from operations excluding working capital); deducting $16mm maintenance capex would leave $18mm of free cash flow, which is almost 100% used toward paying dividends.

Since free cash flow mirrors dividend payments, this also means FCF yield = dividend yield = ~6.2% at the current price of $13.2 per share.

I would give this idea a B. It has enough defensiveness and growth optionality, but the apartment reviews are something to monitor. That NXRT is externally managed is another ding. I have a small amount of NXRT in my IRA account.

No comments:

Post a Comment