At this price, Vipshop (VIPS) is a situation where a short term trading approach can turn into a longer term investment. I bought at $11.1 last week. The stock is at $11.5 now but the logic still holds.

I did not spend a lot of time researching VIPS– altogether no more than 8 hours. More research will be not be productive. I already have enough information to know that:

1) Stock priced in lots of negatives already, and the upside is big if things go right.

2) The technical set up provides a high probability of a short term trading win with minimal downside.

3) I’m not ready to assess VIPS’s longer term growth prospects, at least not until revenue growth stabilizes. But the likely short term trading gains could tide me over until then, and provide the cushion to turn this into a longer term bet.

Brief Background

VIPS is an online discount retailer for apparel brands in China. Apparel brands/manufacturers often end up have excess inventory to get rid of, but they don’t want to flood their stores with big discounts. VIPS is one of the ways that manufacturers can offload inventory. VIPS would organize “flash sales” on its website, selling these items at 30% to 70% off the original retail price. Most of their inventory for now is based on consignment, meaning VIPS bear little inventory risk.

VIPSHop came from a friend who compared it to the online TJ Maxx of China. It didn’t really appeal to me at first - I’m just not much into shopping for clothes. While I was away for Christmas vacation, I watched to stock drift lower and lower, and I finally decided to take a look.

What Is The Market Saying?

Revenue has been growing more than 50%+ per year, it has slowed recently but sell-side analysts still expect revenue to grow 26% in 2017E. 2017E P/E ratio is just a little under 18x. For this type of growth VIPS is incredibly cheap.

Just to put this in context, VIPS is expected to earn about USD $0.48/share for 2016. If EPS grows at 25% CAGR for next 3 years it will earn about $0.94/share in 2019. A consumer stock growing double digits in China should easily command an 18x multiple, justifying a $17 stock price.

Clearly, the market thinks that’s not going to happen.

With VIPS trading <$12, the market is basically saying a) growth will decelerate drastically or even decline 3-5 years out, or b) there are concerns of fraud.

There were in fact accusations of fraud, but that was over a year ago and GeoInvesting actually came out defending the company. At this point I think it’s got to be a small and diminishing factor in the stock price.

So it’s more about the sustainability of growth, and by extension VIPS’s business model itself (footnote 1). You can argue both sides. I lean toward the optimistic side but honestly– anything can happen. I’m certainly not one to claim any sort of conviction here.

On the bear side, one can easily think of some risk/concerns for VIPS. The discount retailer model is far from a sure thing – the success of TJ Maxx is an exception, not the rule. There are also questions as to how the discount model can carry online. Retailers can show deep discounts on their websites directly (like some already do in the U.S.), so the need for something like VIPS is questionable.

Competition will surely be tough. The fact that revenue has decelerated in recent quarters would seem to suggest other players are taking share. It puzzles me that VIPS is expanding into the financing business (for consumers, suppliers, and even selling private wealth management). Is that really the most effective way to juice growth? If you need to finance apparel purchases to increase growth, isn’t that a sign of desperation?

On the other hand, a bull would say yes, there are many ways for manufacturers to offload inventory, but this is China we’re talking about there. The market is big enough to have all these different channels. The company’s revenue may be slowing as percentage, but it’s growing off a larger base and that growth is actually larger in dollar terms. The upside is huge if and when the negative sentiments are lifted. If VIPS could sustain double digits CAGR for a few years and then not fall off a cliff, that business could trade closer to 20x P/E

I’m not smart enough to predict how the future will play out, or even assign probabilities. But I do know that IF it works, the stock can be up 50% or even double. How if it does not work? Well the stock already reflect much of the “not work” scenario.

What’s the floor value of VIPS in the next 3 years? Again, I don’t know. In the next month or so though, the downside is low and that’s a good starting point.

Where to Cap My Downside?

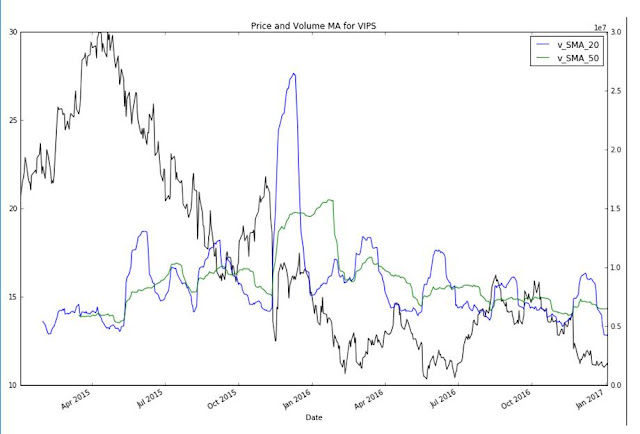

Here’s a chart showing 2 year stock prices against volume moving averages. The black line is the price (left axis), the blue and green lines (right axis) are the volume moving averages. I do this to smooth out volume fluctuations and get a better sense of volume trends.

The blue line (1 month moving average of volume) shows signs of capitulation selling with volume spike during late 2015 and early 2016. This was followed by a period of lowering volumes, signaling investor disinterest. It seems that growth/momentum investors have abandoned the stock, leaving value investors with lower expectations.

I would also note the historical demand around the $10-11 area. Each time the stock dropped to $10.3 the buyers showed up. Even after the disappointment in 3Q16, the stock seems to bottom around $11.

Finally, this stock can run up between earning releases. This happened prior to the 8/15/2016 earning, as the stock rallied some 50% from its June lows. Serious resistance doesn’t show up until ~$15-$16 range.

Game Plan – Buy the Stock < $12

There’s not going to be an earnings release for at least a month or so. In the meantime there’s unlikely any catalyst to shock the stock below its $10-11 support zone. So both the probability and severity of downside is low in the next month or so.

If the stock falls below $10 then I'm probably wrong and I'll take a small loss. If the stock doesn’t move I could cut down before earning release. I might have limited losses, or limited gains – it’s a coin toss.

There's a good chance I might even get 15-20% upswing given the low price – there’s precedent for more. In that case, those gains would allow me to hold through the earnings, as the gains will serve as a cushion for any drops from earning disappointment. If 4Q16 turn out to be good, the stock could roar higher, giving me even more cushion to hold longer term – for the real bet - that the business is sustainable after all.

Taken altogether - my downside is 10-15%, short term upside some 15-20%, long term upside could be 50% or even double. Regardless of my doubts about the company, I have to take the trade.

Notes

1. VIPS may not be cheap if there’s not a “mature phase” of this company. The multiple seems absurdly cheap if you think the company will grow double digits for a few years then revenue stabilizes at some level – a theoretical “steady state” for valuation purposes if you will.

That works for most companies, but an internet company? I’m not sure. It could be either you’re gaining share and growing, or your losing and dying – maybe there’s not this “steady state”. In a DCF model, revenue/cash flows would grow to some peak, slow down, then decline precipitously. That would justify the apparently low multiple. The market seems to price in some probability of this.

That works for most companies, but an internet company? I’m not sure. It could be either you’re gaining share and growing, or your losing and dying – maybe there’s not this “steady state”. In a DCF model, revenue/cash flows would grow to some peak, slow down, then decline precipitously. That would justify the apparently low multiple. The market seems to price in some probability of this.

No comments:

Post a Comment